2026 Top Heavy Machinery Dealer Trends and Innovations?

In the ever-evolving landscape of the heavy machinery industry, 2026 is shaping up to bring significant changes. Heavy machinery dealers are facing new challenges and opportunities. Technology continues to disrupt traditional methods, forcing dealers to adapt swiftly.

Emerging innovations such as telematics and electric machinery are reshaping inventory and sales strategies. Dealers must embrace these trends to stay competitive. The rise of digital platforms is altering how customers interact with dealers. Online sales and virtual showrooms are becoming commonplace, creating both excitement and uncertainty.

As the industry evolves, heavy machinery dealers need to reflect on their business models. Are they adapting quickly enough? The pressure to innovate can be overwhelming. However, embracing change may lead to better customer connections and enhanced profitability. The future of the heavy machinery dealer landscape is bright, yet daunting. Engagement with these trends is essential for success.

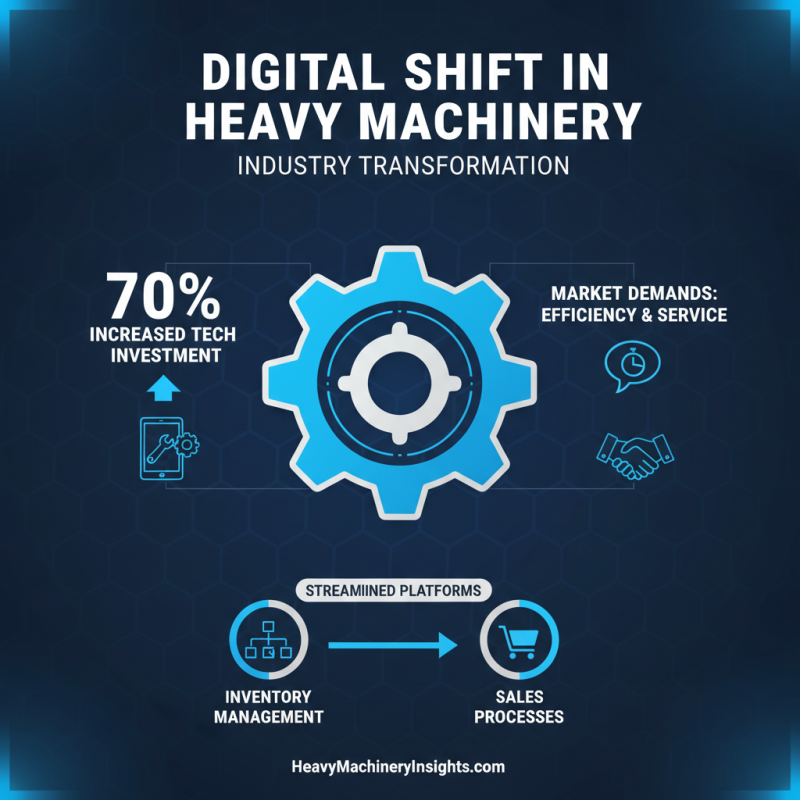

2026 Trends in Heavy Machinery Dealer Digital Transformation

The heavy machinery industry is seeing a notable shift towards digital transformation. According to recent studies, 70% of dealers report increased investment in technology. This reflects a response to market demands for better efficiency and enhanced customer service. Digital platforms are now being used to streamline inventory management and sales processes.

Data shows that 65% of heavy machinery dealers are adopting cloud-based solutions. These tools provide real-time data access, improving decision-making. Yet, the transition is not without challenges. Many dealers struggle with integrating new technologies into existing workflows. A reported 40% of executives find resistance within their teams.

Furthermore, the rise of e-commerce has reshaped purchasing behaviors. Nearly 60% of customers prefer online transactions for parts and services. Dealers must adapt swiftly or risk falling behind. Embracing innovation is essential, but there is a learning curve. The need for ongoing training and support is critical as companies navigate this digital landscape.

Impact of AI and Automation on Heavy Machinery Sales Strategies

The integration of AI and automation is reshaping heavy machinery sales strategies in profound ways. According to a report from MarketsandMarkets, the global AI in the heavy machinery market is projected to reach $4.06 billion by 2026, reflecting a significant demand for intelligent solutions. With predictive analytics, dealers can anticipate machinery maintenance needs, minimizing downtime. This automation leads to better customer satisfaction but requires new skills from sales teams.

A recent study highlighted that about 65% of dealers are investing in digital tools. These tools provide data-driven insights for decision-making. However, not every dealer is on board with new technologies, creating a gap in capabilities. Many find it challenging to adapt their traditional sales approaches to these modern demands. Implementing training programs can address this issue.

Tip: Leverage data analytics for customer insights. Use these insights to tailor your approach, enhancing engagement. Consider trial programs to ease customers into new technology. Heavy machinery dealers must embrace these shifts or risk falling behind. The path ahead is not just about machinery; it's about evolving sales tactics as well.

Sustainability Trends in Heavy Machinery Distribution and Operations

Sustainability is changing the heavy machinery industry. Dealers are now focusing on eco-friendly practices. New technologies help reduce emissions and waste. Using electric machinery and alternative fuels is gaining popularity. These changes are not just trends; they are essential for the industry's future.

Many distribution centers are adopting energy-efficient systems. Solar panels and efficient lighting are common. However, some dealers still struggle with implementation. Training staff on sustainable practices can be challenging. There are also costs involved that can't be ignored.

Recycling materials is a key step toward sustainability. Yet, not all companies are fully committed. Some still overlook the importance of reducing single-use plastics. As customers demand greener options, the pressure to improve is rising. The shift toward sustainability is not perfect, but the movement is evident. Heavy machinery dealers must continuously adapt to stay relevant.

2026 Top Heavy Machinery Dealer Trends and Innovations

| Trend/Innovation | Description | Impact on Sustainability | Year of Implementation |

|---|---|---|---|

| Electric Heavy Machinery | The transition from diesel to electric machinery to reduce emissions. | Significantly lowers the carbon footprint in heavy equipment operations. | 2024 |

| Telematics and IoT Integration | Use of real-time data collection for optimizing machinery performance. | Improves energy efficiency and reduces unnecessary fuel consumption. | 2025 |

| Sustainable Material Usage | Incorporation of recycled materials in machinery manufacturing. | Reduces waste and promotes recycling initiatives in the industry. | 2026 |

| Advanced Battery Technologies | Development of longer-lasting battery systems for heavy machinery. | Enhances machine run time, lowers charging frequency, and improves overall efficiency. | 2026 |

| Circular Economy Practices | Focus on repairing and reusing machinery rather than outright disposal. | Promotes sustainability by extending the lifecycle of machinery. | 2025 |

Innovations in Equipment Rental Models for Heavy Machinery Dealers

The heavy machinery rental market is evolving rapidly. Innovations in equipment rental models are reshaping how dealers operate. A recent report from the Association of Equipment Manufacturers indicated that rental revenues are expected to grow at a compound annual growth rate of 5.6% through 2026. This trend opens new avenues for heavy machinery dealers.

Many dealers are adopting flexible rental options. These include pay-per-use models and subscription services. A shift towards shorter rental periods is evident. Customers seek access to the latest technology without long-term commitments. This flexibility attracts small to medium-sized businesses looking for efficiency.

Moreover, technology integration is crucial in enhancing rental services. Digital platforms allow for real-time monitoring of equipment. Dealers can prepare maintenance schedules proactively. However, the challenge remains in the need for reliable data and effective communication with customers. Real-time data analysis is still a work in progress for many. Striking the right balance between technology and customer relations is key for future success.

2026 Top Heavy Machinery Dealer Trends and Innovations

This chart illustrates the market share of different equipment rental models among heavy machinery dealers in 2026. Model A leads with 25% market share, highlighting the shift towards diverse rental options in the industry.

Data Analytics: Driving Customer Insights in Heavy Machinery Sales

Data analytics is revolutionizing the heavy machinery sales landscape. According to a recent report, over 70% of industry leaders are investing in data-driven technologies. These tools help companies understand customer behavior and preferences better. Accessing this data allows businesses to tailor their offerings and improve customer relations significantly.

With the rise of IoT, companies can gather real-time data from machinery in the field. This data is invaluable. It helps predict maintenance needs, which can enhance sales strategies. Sales teams can approach clients before machinery failures occur. This proactive approach can lead to increased customer trust and satisfaction. However, many companies struggle to interpret this data effectively. There is a learning curve that requires investment in skills and tools.

Listening to customer feedback is equally essential. Reports indicate that nearly 60% of customers value personalized experiences. Ignoring these insights can lead to missed opportunities in sales. Despite the advancements in analytics, some businesses still rely on intuition. This outdated approach is less effective in today’s data-driven environment. The challenge lies in integrating analytics meaningfully into sales strategies. Companies must not only collect data but also act upon it responsively to remain competitive.

Related Posts

-

10 Essential Tips to Find the Best Link Belt Dealer Near You

-

How to Choose the Best Logging Equipment for Your Needs

-

What is Construction Equipment Machine? Types, Uses, and Benefits Explained

-

How to Choose the Right Heavy Equipment Company for Your Project Needs

-

Top Equipment Machines to Watch in 2025 for Increased Efficiency and Productivity

-

Finding the Best Link Belt Parts Dealer for Quality Service and Parts

Subscribe to our newsletter.